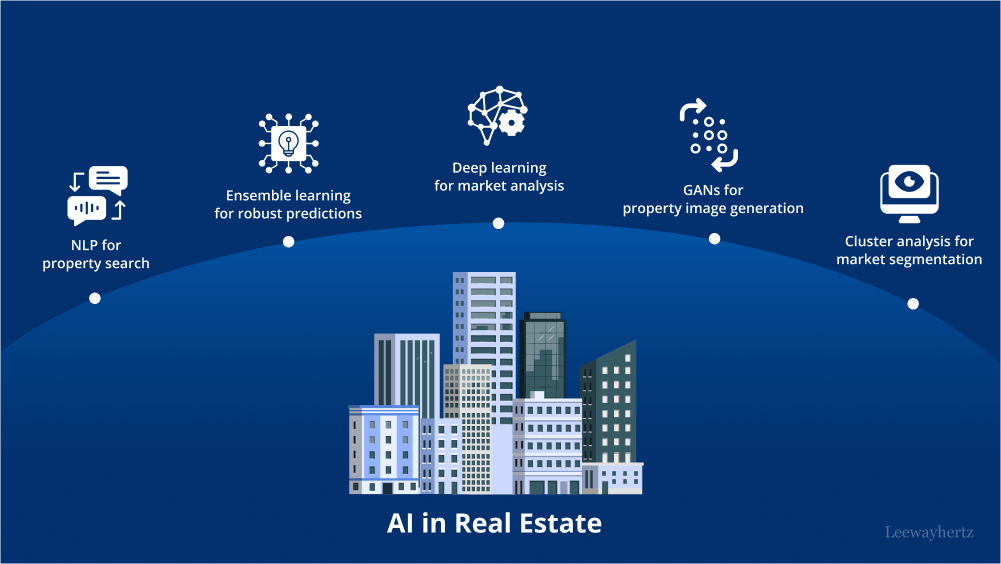

Artificial Intelligence (AI) is revolutionizing the real estate industry, from property valuations and predictive analytics to virtual tours and customer service automation. While AI offers significant advantages, it also introduces new challenges that need to be addressed for ethical, legal, and practical adoption in the real estate sector.

What Are the Challenges of AI in Real Estate?

AI in real estate refers to the use of machine learning algorithms, data-driven decision-making tools, and automation technologies to assist in property buying, selling, investment, and management. Although it enhances efficiency, AI presents several concerns that impact privacy, fairness, and market dynamics.

Key Challenges in AI and Real Estate

Data Privacy and Security

AI systems rely heavily on vast amounts of personal and financial data to deliver accurate property recommendations, pricing estimates, and investment insights. Ensuring this data is protected from breaches and unauthorized access is a major challenge, especially with increasing cybersecurity threats.

Bias and Discrimination

AI algorithms can unintentionally reflect or amplify biases present in the data they’re trained on. In real estate, this can lead to discriminatory practices in pricing, lending, or property recommendations, particularly against marginalized communities, raising fair housing concerns.

Transparency and Explainability

Many AI models operate as “black boxes,” offering outputs without clear reasoning. In real estate, this lack of transparency can make it difficult for buyers, sellers, and agents to understand why certain properties are recommended or why specific valuations are generated, reducing trust in the system.

Regulatory and Legal Uncertainty

As AI tools grow in influence, legal frameworks are still catching up. Questions about accountability, compliance with fair housing laws, and ethical use of data are becoming increasingly complex. Without clear regulations, real estate professionals may face legal risks when using AI-powered platforms.

Overreliance on Automation

While AI can streamline decision-making, overdependence on automation may overlook human judgment, local market knowledge, and emotional intelligence—critical elements in real estate transactions. This can lead to poor recommendations or missed opportunities.

Market Manipulation Risks

There’s growing concern that AI could be used to manipulate pricing trends or influence buyer behavior at scale. For instance, algorithmic pricing tools might unintentionally inflate property values or create artificial scarcity in certain neighborhoods.

Conclusion

AI in real estate has the potential to drive smarter, faster, and more efficient processes across the industry. However, addressing challenges related to data privacy, bias, transparency, and regulation is essential for building a trustworthy and equitable real estate ecosystem. By blending AI innovation with ethical guidelines and human oversight, the industry can fully harness the benefits of AI while minimizing its risks.

Leave feedback about this